Arvest Central Mortgage: A Comprehensive Guide to Home Financing

Introduction:

When it comes to purchasing or refinancing a home, finding the right mortgage provider is crucial. Arvest Central Mortgage is a reputable and trusted name in the industry, offering a range of financing options to meet the diverse needs of homeowners. In this article, we will explore the services provided by Arvest’s Central Mortgage, how they can assist you in achieving your homeownership goals, and address some frequently asked questions. Read more

Arvest Central Mortgage: Your Home Financing Solution

Arvest Central Mortgage is committed to providing exceptional service and expertise to individuals and families looking to finance their dream homes. With a wealth of experience and a strong reputation for customer satisfaction, Arves’s, Central Mortgage has become a top choice for borrowers across the country. Read more

Services Offered by Arvest’s Central Mortgage:

Arvest’s Central Mortgage offers competitive loan programs tailored to suit various homebuyers’ needs. Whether you are a first-time homebuyer or an experienced buyer looking for a new property, Arvest Central Mortgage provides flexible financing options and assistance throughout the entire process. If you already own a home and are seeking better loan terms, Arvest Central, Mortgage offers refinancing options to help you save money and achieve your financial goals. With their refinancing solutions, you can lower your monthly payments, reduce your interest rate, or even shorten the term of your loan. Arvest Central, Mortgage understands the importance of providing convenient tools and resources to streamline the mortgage application process. Their user-friendly online platform allows borrowers to calculate mortgage payments, access mortgage rates, and submit applications from the comfort of their own homes. Read more

FAQs:

What types of loans does Arvest’s Central Mortgage offer?

Arvest’s Central Mortgage offers a wide range of loan options, including conventional loans, FHA loans, VA loans, and USDA loans. They strive to match borrowers with the loan program that best fits their financial situation and goals.

How do I apply for a mortgage with Arvest’s Central Mortgage?

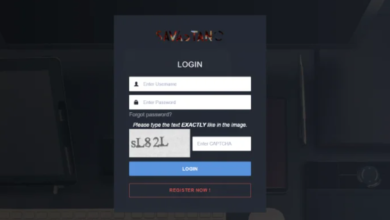

Applying for a mortgage with Arvest’s Central Mortgage is a simple process. You can start by visiting their website and filling out an online application. Alternatively, you can contact their experienced loan officers who will guide you through the application process and answer any questions you may have.

Can I make payments online?

Yes, Arvest’s Central Mortgage provides an online portal that allows borrowers to conveniently make their mortgage payments. This secure platform also enables borrowers to view their account details and access important loan documents.

What factors affect mortgage interest rates?

Several factors influence mortgage interest rates, including credit score, loan term, loan amount, and current market conditions. Arvest’s Central Mortgage’s team of experts will help you understand these factors and guide you in securing the most favorable interest rate for your loan.

Are there any advantages to refinancing my mortgage?

Refinancing your mortgage with Arvest,s Central Mortgage can offer various advantages, such as lowering your monthly payments, reducing your interest rate, or accessing equity for other financial needs. However, it is essential to evaluate your specific circumstances and consult with their loan officers to determine if refinancing is the right choice for you.

Conclusion:

Arvest,s Central Mortgage is a trusted and reliable partner for those looking to navigate the complex world of home financing. Their comprehensive range of services, commitment to customer satisfaction, and user-friendly online tools make them an excellent choice for borrowers at every stage of homeownership. Whether you are purchasing a new home or considering refinancing, Arvest,s Central Mortgage is ready to assist you on your journey to homeownership. Contact them today to explore the options available and start turning your homeownership dreams into reality. Read more