Finance

Toys R US Credit Card Login, Customer Services, Payments

In this articles you will learn all information about the Toys R US Credit Card as a holder. You will learn how to login into your account, and how to reach customer services, online payments.

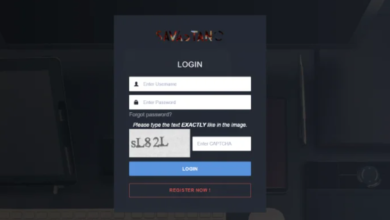

Login Access to online Account

Login on this link to make payments and access your account

Customer Service Helpline

Toys R Us Mastercard / Synchrony Mastercard phone number: 1-855-389-2359

Toys R Us / Babies R Us store credit card phone number: 1-855-389-2365.

Payment Address of Credit Cards

Toys R Us / Synchrony Mastercard:

R Us Mastercard

P.O. Box 669813

Dallas, TX 75266-0760